There are some who play by the book and there are some who don't. Stock markets are no different.

Some traders play with a straight bat, while others not only bend the rules, but also break the law.

Let us take a look at some famous traders who indulged in illegal insider trading.

. . .

World's 9 most-famous insider trading cases

Image: He was the 236th richest American in 2009.Raj Rajaratnam is a Sri Lankan-born American citizen of Tamil descent who founded the Galleon Group, a New York-based hedge fund management firm.

On October 16, 2009, he was arrested by the FBI on allegations of insider trading, which also caused the Galleon Group to close.

His attorney indicated that Rajaratnam would plead not guilty and fight the charges of insider trading in court.

On October 13, 2011, Rajaratnam was sentenced to 11 years in prison.

He was the 236th richest American in 2009, with an estimated net worth of $1.8 billion.

Rajaratnam started his career as a lending officer at the Chase Manhattan Bank where he made loans to high-tech companies.

He joined the investment banking boutique Needham and Co as an analyst in 1985, where his focus was on the electronics industry.

He became the head of research in 1987 and the president in 1991, at the age of 34.

At the company's behest, he started a hedge fund - the Needham Emerging Growth Partnership - in March 1992, which he later bought and renamed 'Galleon'.

. . .

World's 9 most-famous insider trading cases

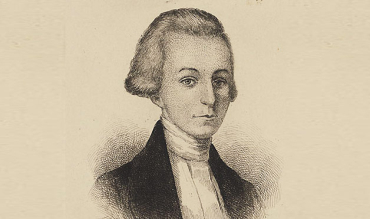

Image: William Duer is considered to be the first inside trader in US history.British-born entrepreneur William Duer is considered to be the first inside trader in US history.

Appointed by Alexander Hamilton in 1789 as the Assistant Secretary of the Treasury, he quit his job in 1790, but not before getting enough inside information to make bets on bank stocks.

Duer tipped off his friends and traded his own portfolio before leaking information that would drive up prices, which he then intended to sell for profit.

His investments didn't pay off, however, and in 1792, Duer was stuck with bad investments and huge debts.

His bankruptcy ended up taking down much of the New York Stock Exchange, and he died in 1799 in debtors' prison.

. . .

World's 9 most-famous insider trading cases

Image: Wiggin made $4 million from the 1929 crash.During the 1920s, most Americans knew the stock market was a rigged game, which is why they were out for blood after it crashed in 1929.

As it turned out, Albert H Wiggin, the head of Chase National Bank, had shorted 40,000 shares of his own company using family corporations to hide the trades.

Essentially, Wiggin built up a position that made it profitable for him if his company failed.

Since there were no laws against this in 1929, Wiggin made $4 million from the 1929 crash.

He also got a $100,000 a year pension for life from the bank, which he later declined after public outrage.

. . .

World's 9 most-famous insider trading cases

Image: Levine was sentenced to two years.On May 12, 1986, Drexel Burnham Lambert investment banker Dennis Levine turned himself in to the New York City Attorney General's office after being informed he would be charged with insider trading.

Leveraging inside information, Levine earned $2.69 million in the takeover of Nabisco; his knowledge also helped stock trader Ivan Boesky earn more than $50 million.

Levine ended up becoming a witness against Boesky, which created a domino effect when Boesky turned in audiotapes he had of conversations with other guilty parties.

Levine was sentenced to two years, Boesky to three years, and in 1990, the Drexel firm filed for bankruptcy.

. . .

World's 9 most-famous insider trading cases

Image: Winans's tips made his co-conspirators almost $1 million.R Foster Winans, a writer for The Wall Street Journal in the early 1980s, co-wrote 'Heard on the Street', a financial column so influential that it could move markets.

During his tenure, he decided to make money off his knowledge by leaking information to stockbroker Peter N Brant and others before publication.

While Winans's tips made his co-conspirators almost $1 million, his payout was only $31,000.

Winans served eight months of an 18-month sentence and paid a $5,000 fine for misusing the Journal's information, but was ultimately never convicted of insider trading.

. . .

World's 9 most-famous insider trading cases

Image: Jeff Skilling was also accused of insider trading.While the Enron case was primarily an accounting scandal - the company lied about its debts and losses to cover up its deterioration - insider trading was certainly one of the many charges filed against the guilty parties.

Jeff Skilling, the company's former CEO, was convicted of 18 counts of fraud and conspiracy, and one count of insider trading in 2006.

Although he was acquitted of nine other counts of insider trading, he was still sentenced to 24 years and four months in jail.

. . .

World's 9 most-famous insider trading cases

Image: Martha Stewart was indicted on nine criminal counts of insider trading.In June 2003, Martha Stewart and her broker, Peter Bacanovic, were indicted on nine criminal counts of insider trading.

Stewart had sold her ImClone Systems stock in 2001 after Bacanovic advised her to because another client of his, ImClone CEO Sam Waksal, had dumped his own shares.

The next day, ImClone announced that the FDA had refused to file its license application for a new cancer drug, and ImClone's stock price dropped 16 percent, which would have lost Stewart $45,673.

In 2006 Stewart settled with the SEC without being convicted, but only after she served five months in federal prison for covering up information during the FBI investigation.

. . .

World's 9 most-famous insider trading cases

Image: Balkenhol made $82,000 in profits.Christopher Balkenhol got a lot more from hearing about his wife's day than most husbands do.

Carolyn Balkenhol, who was the secretary for Oracle CEO Larry Ellison, had access to the schedules of the CEOs and copresidents, and was privy to several confidential merger meetings.

After she shared this information with her husband, he went on to buy $448,000 worth of shares in one of the companies Oracle was planning to purchase.

Balkenhol made $82,000 in profits, but never admitted any wrongdoing. He settled out of court in 2007, paying a $198,000 fine.

. . .

World's 9 most-famous insider trading cases

Image: Moffat was sentenced to six months in jail.In March 2010, former IBM executive Robert Moffat admitted he told inside information to New Castle Funds consultant Danielle Chiesi, with whom he allegedly had an intimate relationship.

The crime also implicated 12 other people, including Raj Rajaratnam. Moffat was sentenced to six months in jail and charged a $50,000 fine.

article